Vehicle Diminished Value FAQs

- What is Diminished Value?

Diminished value is the loss in your vehicle's market value after an accident, even after it has been repaired.

- When is my vehicle declared a total loss?

A vehicle is declared a total loss if repair costs exceed 75% of its retail value or if the salvage value plus repair costs exceed the retail value. The insurance company has the final say in declaring a total loss.

- Can I dispute the valuation the insurance company presents?

Yes, you can dispute the insurance company's valuation for both total loss and diminished value cases.

- How long does it take to collect a fair settlement after starting a dispute?

On average these are settled between 30 – 45 days, however some insurance companies will intentionally delay this process causing it to take longer.

- If my car is financed, do I qualify for diminished value?

Yes, as long as you are the registered owner, you can claim diminished value.

- If my car is leased, do I qualify for diminished value?

Typically, only the registered owner can claim diminished value, but you might be able to negotiate with the lessor.

- If my car had a previous accident, does it still qualify for diminished value?

Yes, but the compensation may be reduced due to the vehicle's accident history.

- The insurance company sent me a check for diminished value. Should I cash it?

No, do not cash the check immediately. First, send a response letter and an appraisal to the insurance company. You can deposit the check as partial payment later.

- What if I already cashed my diminished value check?

If you cashed the check recently, you might still be able to request additional compensation. If you signed a release of liability, further compensation may not be possible.

- Does my vehicle need to be repaired before claiming diminished value?

Yes, repairs must be completed to assess diminished value accurately.

- Can I fix the car myself?

No, repairs need to be done by an approved body shop.

- How much can I expect for diminished value?

The amount depends on the severity of the accident and the type of car. Visit our Estimate page for a free quote.

- Do I need an attorney to help me collect diminished value?

No, but an attorney can be helpful for resolving bodily injury claims and other non-property-related damages.

- What is 17c?

17c is a formula used by insurance companies to calculate diminished value, but it is often inaccurate. Learn more about why 17c is problematic on our website.

- Can I still apply for diminished value if I already sold my car?

This depends on the insurance company, but in most cases, yes, you can still apply.

- Do I need an inspection?

No, an inspection is not needed when pursuing inherent diminished value.

- How long will it take to get your report?

You will receive the report within a week in most cases.

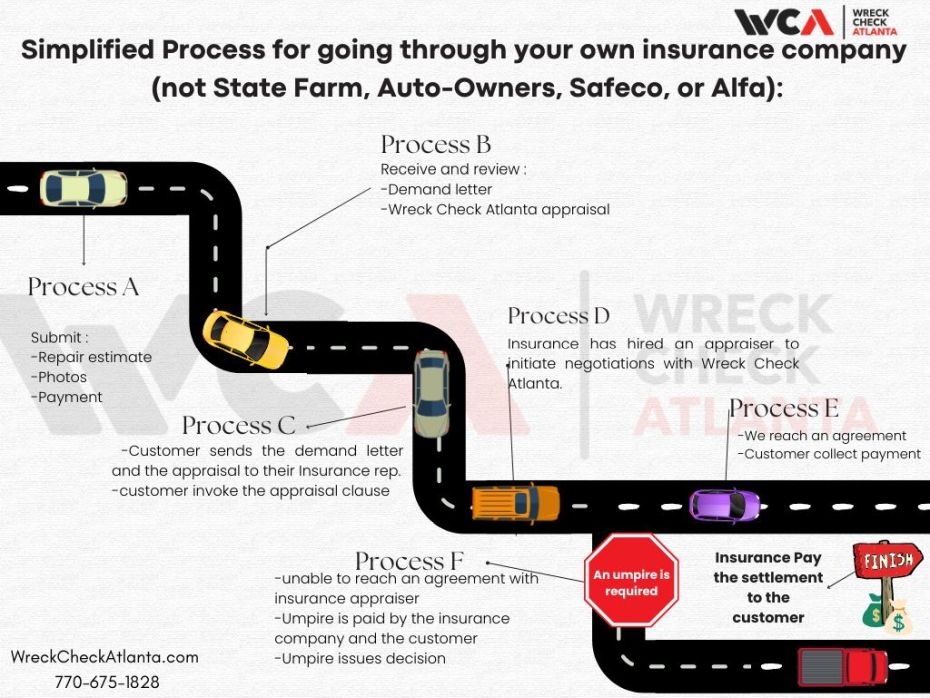

- What happens if the insurance company gets their own appraiser?

This is usually good news. We can negotiate with their appraiser to reach a settlement.

- My repair cost was less than $1,000. Can I still claim diminished value?

Yes, high-end or luxury vehicles can still be affected by diminished value even with minimal damage.

- Will my accident show up on the Carfax report?

If there is a police report, then yes, it will likely appear on the Carfax report. Otherwise, it might not.

- Can I hire an out-of-state appraiser?

While you can hire an out-of-state appraiser, it is not recommended due to Georgia's unique laws and processes for diminished value claims. An out-of-state appraiser may not be familiar with these specifics and may not be able to attend court if needed.

- Is an independent appraiser hired by an insurance company?

An independent appraiser can be hired by anyone seeking an unbiased opinion. They are not salaried employees of an insurer or government agency and can perform appraisals for anyone.

- The company wants to charge more than the agent quoted. Is that legal?

Yes, the company can make the final decision about your rating classification after reviewing your information. Intentional low-balling by an agent is illegal.

- My son has left home for college. Do I still have to include him on my policy?

Yes, as college students often have access to the family car when home. The company might reduce premiums if the college is far from your home.

- I’ve had 2 accidents that were not my fault. Can the company raise my premium?

No, according to Georgia law, insurance companies cannot raise your premium for accidents that were not your fault.

- Sometimes I let a friend drive my car. Is she covered by my policy?

Probably. Most liability policies cover a licensed driver who drives your car with your permission. Some policies, however, may have specific restrictions.

- The insurance company put the bank’s name on the check for fixing my car. Why?

Because your car is collateral for your loan, the bank has an interest in ensuring the money is used for repairs.

- Do I need a Diminished Value Attorney?

In most cases, you do not need an attorney to dispute a diminished value claim. Over 95% of our clients receive a reasonable settlement with our assistance. For the few who go to small claims court, hiring an attorney is usually unnecessary. If your claim exceeds the small claims court's authority, consulting with an attorney may be beneficial. Wreck Check Atlanta can support your attorney in prosecuting your case. If your claim involves both personal injury and diminished value, a personal injury attorney may be best suited to protect your interests.

Of our clients who filed suit and went to court, 99% won their case, with the insurance company paying the diminished value, court costs, and our fees.

Consult With Wreck Check Atlanta

If you are unsure whether hiring an attorney is the right move for your situation, consult with Wreck Check Atlanta. We can assess your case and determine if the insurance company is trying to pressure you into accepting an unfair settlement. Call our offices today to learn more about post-repair assessments and appraisal services in your state.