The Appraisal Clause Process Explained

The appraisal clause in your insurance policy can help you resolve disputes over vehicle repair costs, diminished value, and total loss value. Understanding this clause can be advantageous in navigating these disputes.

What is an Appraisal Clause? An appraisal clause is a standard feature in most insurance policies. It allows you and your insurer to settle disagreements about the amount of a loss. This clause is typically found in the “Damage to Your Auto” section of your policy.

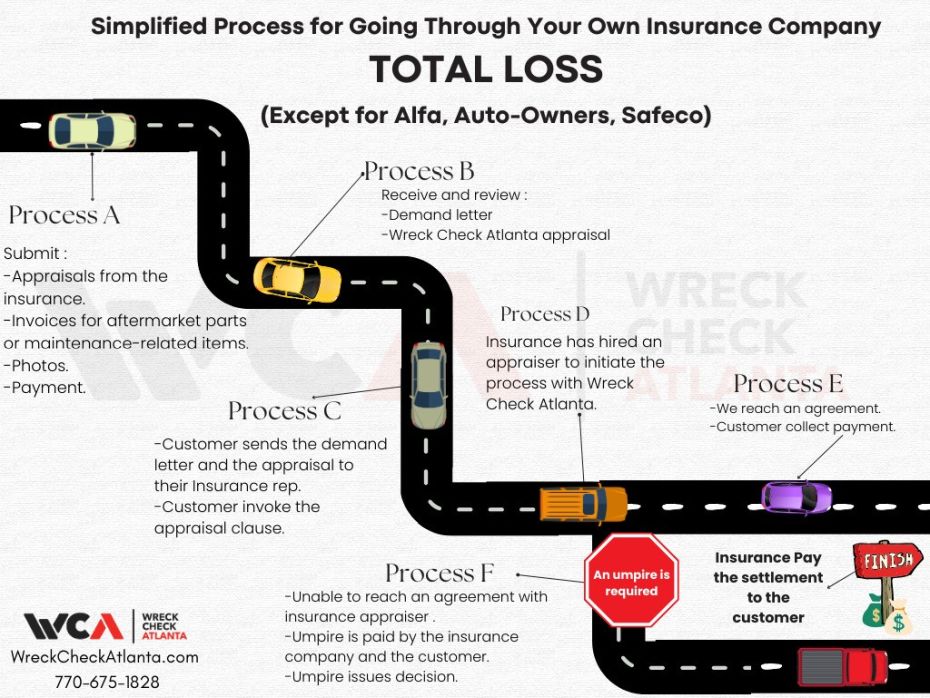

- Step 1: Invoking the Appraisal Clause

- If you and your insurer can’t agree on the amount of a loss, you can invoke the appraisal clause by writing to your insurer. This can be done via certified mail with a return receipt or email (confirm receipt with your claims agent).

- Step 2: Selecting Appraisers

- Each party selects an appraiser to assess the loss. You will pay for your appraiser, and your insurer will pay for theirs. Choose an appraiser with experience in the type of dispute and appraisal process you are dealing with, ensuring they are objective and impartial.

- Step 3: Reaching a Conclusion

- The two appraisers will assess the loss and attempt to agree on a settlement amount. If they cannot agree, they will select a neutral third-party appraiser, known as an umpire. The decision agreed upon by any two of the three appraisers will be binding. You and your insurer will share the cost of the umpire.

For more information on the appraisal clause process in Georgia, contact Wreck Check Atlanta today.